Share Market Knowledge: If you see these indicators in a falling stock, understand that the bulls have entered, invest money, print notes.

Candlestick patterns are important in technical analysis.A bullish engulfing pattern is formed by joining two sessions.Many times a stock rises after its appearance.

Share market knowledge: As attractive as the stock market looks from the outside, it gets tougher once you get inside. This is the reason why most of the small investors and traders lose money in the market while only 5-10% people make profit. So the question arises, what are the things people who make money in the share market look for when investing? Anyone can make money if they know it. Technical analysis is one way to know about the possible movement of the stock market or any share. Today we are telling you about an important thing in this analysis, which can tell about the stock movement.

The main technical analysis thing we are talking about today is candlestick patterns. This pattern is called Bullish Engulfing. As the name suggests, this is a bullish pattern. To find it you must know how to read the charge. These days all brokers offer charting option in demat account. You can find this pattern on the same app or its desktop version. Also some specialized apps are used only for charting, such as investing.com and tradingview.com.

How does this rapid wraparound pattern form?

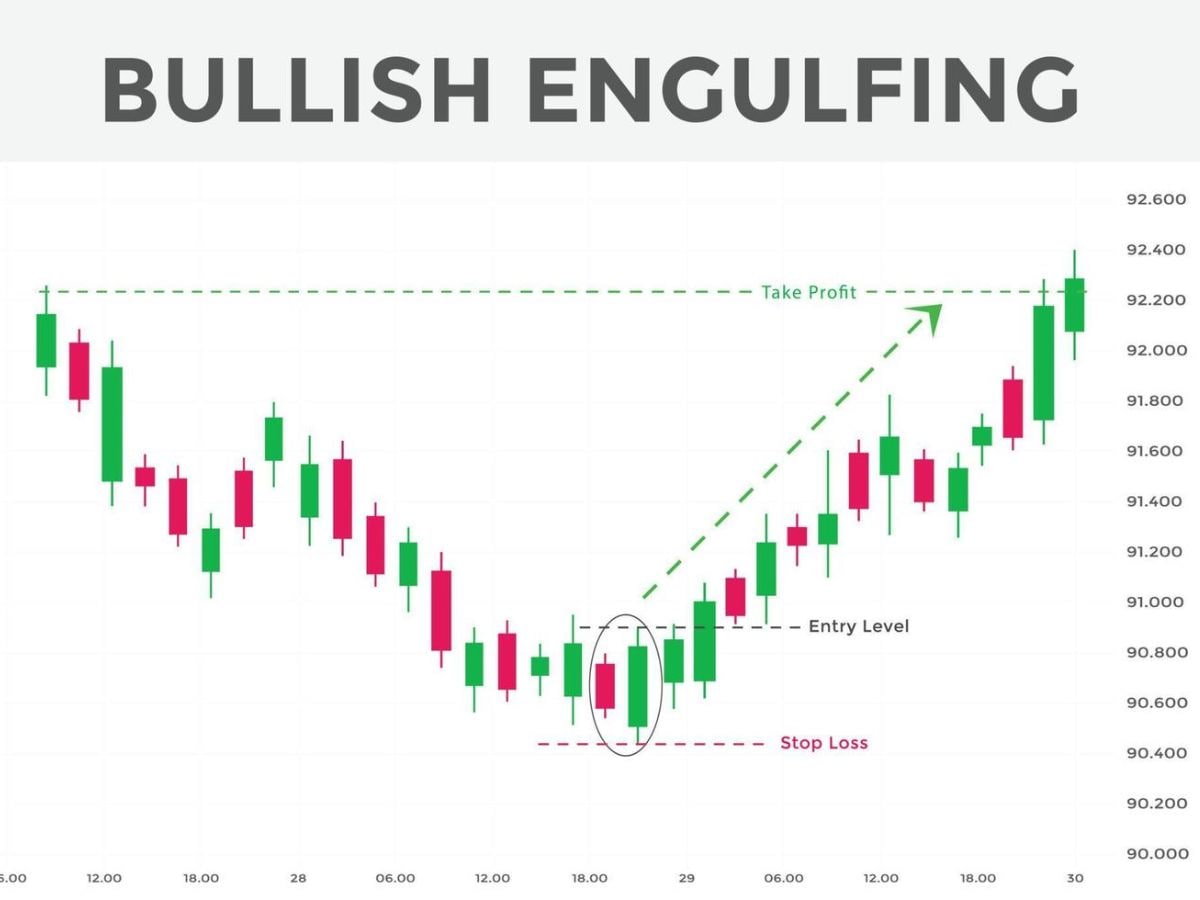

Here an attempt has been made to explain it to you in the simplest possible language. First, separate these two words. Blush + Engulfing. You already know the meaning of Bullish, Ingulf means to swallow. Look at the pattern shown in the image below.

A stock is falling. Many red (high) and green (low) candles are seen forming. Now, look at the green candle marked in the circle. This candle has completely swallowed or covered the previous day’s candle. This is a winding candle. A blush engulfing pattern is formed by combining a small red candle and then a green candle that completely covers it.

According to Zerodha Versity, in this pattern we have to see 2 trading sessions simultaneously. You will see a small red candle first and a large green candle the next day. The green candle is covering the previous red candle.

Which pattern will work best?

Let’s say you watch a stock regularly, and one day you see a bullish rolling pattern on the chart. From here you should understand that now the share price can reverse. Keep in mind here that these samples are not 100% effective. These patterns indicate the possibility of a price reversal. A good investor stays in alert mode after spotting such patterns.

Also Read: LIC Crosses Rs 1000, IPO Buyers Go All Profits, Why This Rise, Know

Such patterns continue to form in many places on the chart. Many times the share price rises slowly and this pattern forms. Sometimes this pattern is formed even when the stock is at its peak. But these patterns usually don’t work. A bullish engulfing pattern is more likely to work when it forms after a long downtrend in the charts. Meaning, one should not rely too much on the pattern formed in the middle of the chart. Looking at this pattern forming in the chart after a long decline, one should understand that the price may reverse.

The logic behind bullish patterns

When a stock falls, it is said to be in the grip of the bears and they are constantly driving the price down. In such a situation you will see more red colored candles. There will also be small green candles in the middle. There comes a time when the bulls feel that the price has dropped significantly and can buy from here. When bulls start buying, their movement is seen in large green candles. Where many bulls feel that the stock is overbought at the same time, they start buying in abundance and large and green candles form. Additionally, the volume bars visible at the bottom also tend to be higher than usual.

A bullish wrap candle is formed when the opening price is lower than the previous day’s opening, but by the time the price closes, it is higher than the previous day’s opening. For example, yesterday a share closed at Rs 100, but opened at Rs 105. That is, it closed down by Rs.5. Today the same share opened at Rs 98 (down Rs 2 from yesterday’s closing price). Here the bulls started buying and took up to Rs 110 till the market closed. Meaning, by cleaning up the entire deficit, the Bulls tried to show that they had arrived and were no longer going to allow the Bears to continue.

To find such candles, you should look at the daily candles (one candle per day) chart. You can also view weekly or monthly charts, but charts with less than 1-day candles should not be viewed. Note again that the formation of a bullish candlestick pattern does not mean that the price will reverse from there. It is an indicator, whereas investment decision is taken after considering some other things along with it. If you are not skilled in technical analysis, you should consult a registered investment advisor.

(Disclaimer: This article is written for informational purposes only. If you want to invest in any stock, consult a certified investment advisor first. News18 will not be responsible for your profit or loss. ).

Tags: make money, Stock market, Stock market

First Publication: February 5, 2024, 15:46 IST

#Share #Market #Knowledge #indicators #falling #stock #understand #bulls #entered #invest #money #print #notes